Copyright © 2005-2024 TradeTools FX All rights reserved.

Software for Forex, Binary Options and сryptocurrency brokers.

+1 708 515 4598 info@tradetoolsfx.com

The PAMM-account, as a financial instrument for investing in the FOREX market, is a relatively young phenomenon that appeared around 2006. At first, the phenomenon was perceived skeptically, however, like everything new that appears on the market.

The PAMM-account, as a financial instrument for investing in the FOREX market, is a relatively young phenomenon that appeared around 2006. At first, the phenomenon was perceived skeptically, however, like everything new that appears on the market.

Beginners of the Forex market treated this investment tool with great suspicion. But for 5 years the situation has changed dramatically, and the PAMM-accounts have become one of the most popular services among the beginners and also the average level of Forex traders because of the convenience of investing and the possibility of optimal diversification of risks.

The annual increase in the opening of PAMM-accounts in Russia per month is 10 times, that is, if, for example, in January 2015, 100 PAMM accounts were opened on one PAMM-site, in January 2016 - 1000, and in the same month 2017 - 10 000 accounts.

Similar statistics on the growth of the popularity of this financial investment tool indicate a rapid increase in the credibility of PAMM-accounts. After all, if they were excessively risky, inconvenient to use and not profitable, then to the present day they would disappear by themselves, without outside interference.

Initially, the PAMM-account, as a service for investing money, was offered by a limited number of forex brokers, but as the demand for this tool increases, by today, the number of Internet sites to enter the Forex market offering such an investment service has grown to several dozen. In addition, not all brokers use the name "PAMM-account", bringing to the market similar services under its own name.

1 comments

1 comments The development of the crypto-currency market caused a new direction of activity - cryptotrading.

The development of the crypto-currency market caused a new direction of activity - cryptotrading.

Modern history already knows examples of successful trade in crypto-currencies, but even more there are cases of failures and losses.

To increase your chances of success, you need to know the basic strategies of cryptotrading and skillfully apply them in your work.

Despite the fact that the crypto-currencies entered our life quite recently, the first thoughts about the creation of independent electronic money appeared in the early 80-ies of the last century. Briefly enumerate the main milestones that preceded the emergence of modern cryptogen and the technology of blockade.

Despite the fact that the crypto-currencies entered our life quite recently, the first thoughts about the creation of independent electronic money appeared in the early 80-ies of the last century. Briefly enumerate the main milestones that preceded the emergence of modern cryptogen and the technology of blockade.

1. In 1983, David Chaum and Stefan Brands for the first time describe the revolutionary for those times concept of electronic money.

2. In 1992 cryptographers Timothy May, Whitfield Diffie and Philip Zimmermann openly voiced the idea of creating an anonymous electronic currency capable of "striking at corporations and removing the state from financial operations." The idea is greeted with warm support from civpopankov.

Cryptoexchange is an online platform that acts as an intermediary between buyers and sellers of cryptocurrency.

For each currency represented on the exchange, a unique ticker is used: for bitcoins - BTC or XBT, for Etherium - ETH, etc.

Bitcoin exchanges help buyers with sellers. As on the traditional exchange, traders can choose: to buy and sell coins, placing a market (market) or limit order (limit order).

When a market order is selected, the trader allows exchanging his coins for others at the best available price on the online market. This is an immediate transaction at the best price.

When a sell order is placed, the trader directs the coin exchange at a price lower than the current demand or above the current rate, depending on whether he buys or sells. This is an application with a price limit.

Which word first comes to mind when we hear the term "cryptocurrency"? Most of us remember bitcoin, the pioneer of the new market, who for several years reigned the ball. Over the years, the picture has changed, and by now the pioneer has lost his monopoly. The success of BTC and the promise of blockade technology have inspired enterprising people around the world - and here is the result: to the question of whether there is an alternative to bitcoin, you can confidently answer "yes." Moreover, there are many alternatives, and many of them deserve the attention of investors.

Which word first comes to mind when we hear the term "cryptocurrency"? Most of us remember bitcoin, the pioneer of the new market, who for several years reigned the ball. Over the years, the picture has changed, and by now the pioneer has lost his monopoly. The success of BTC and the promise of blockade technology have inspired enterprising people around the world - and here is the result: to the question of whether there is an alternative to bitcoin, you can confidently answer "yes." Moreover, there are many alternatives, and many of them deserve the attention of investors.

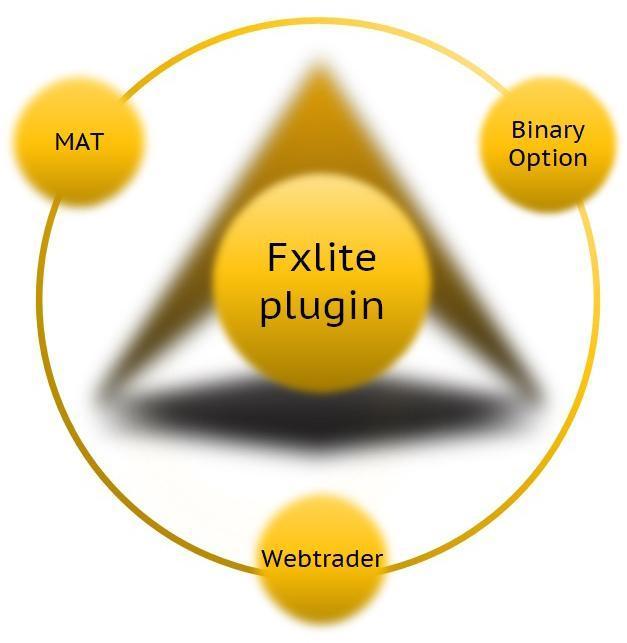

Our team is constantly working on improving products for brokers, adding to the software new features that no one else offers.

Our team is constantly working on improving products for brokers, adding to the software new features that no one else offers.1. Add client's IP to BO position

2. Add MAT and BO rade blocking

3. Import/export BO expirations

4. Added block mobile trade

5. Round BO prices

Crypto currency is less reliable than traditional instruments, therefore, collapses in this market occur more often. How to behave correctly in this situation, and even earn a drop in the market of Crypto-currency?

Crypto currency is less reliable than traditional instruments, therefore, collapses in this market occur more often. How to behave correctly in this situation, and even earn a drop in the market of Crypto-currency?- your crypto currency has value and is supported by developers;

- we are talking about megapopular crypto currency;

- The reason for the fall of the course is not obvious, it is incomprehensible.

Crypto-currency and taxes

Crypto-currency and taxesCrypto currency is equated to a monetary unit, but does not have a physical expression. This type of electronic money is not tied to any country or system.

Crypto currency can not be falsified or prohibited; she is not afraid of inflation. All these advantages, as well as complete anonymity of users, make crypto currency very popular all over the world.

Despite the invulnerability of those who earn on crypto-currencies, the Internet raises the question of taxation. For example, in the US and Japan, the crypto currency is legalized, so it is possible that other countries will follow this example.

Today the issue of the safety of the extracted crypto currency is more acute than ever. The Internet actively discusses the ways and new solutions, often there are disputes, which wallets are better to use. Let's talk about cold wallets today, understand what it is, and how to work with them.

Today the issue of the safety of the extracted crypto currency is more acute than ever. The Internet actively discusses the ways and new solutions, often there are disputes, which wallets are better to use. Let's talk about cold wallets today, understand what it is, and how to work with them.

Regulation of the market crypto-currency: features and nuances

Regulation of the market crypto-currency: features and nuancesThe issue of regulating the market of crypto-currencies now occupies many. This topic interests officials and ordinary people. There are active discussions about whether it is necessary to regulate this market and what actions to take.

Crypto-currencies have firmly entered our reality, therefore it is not possible to ignore their existence and serious influence on the economy. However, the regulation of the crypto-currency market involves a number of objective difficulties.