Binary Options Exchange for MT4 and another trading platforms

What is a foreign exchange option?

Option of exchange - this is the name of a another trading platforms imaccontract that gives the right to buy or sell a currency (in the case of a currency option) at a fixed price (strike) at the exact date in the future. Within a couple of days after the purchase of the option, the buyer must pay the premium to the second party of the agreement in the form of a specified interest rate from the proposed transaction amount. The amount of bonus deductions is the minimum risk that a trader expects at a price that is unprofitable for him, since the right to repurchase the currency at the specified price can be used or not used.

Option of exchange - this is the name of a another trading platforms imaccontract that gives the right to buy or sell a currency (in the case of a currency option) at a fixed price (strike) at the exact date in the future. Within a couple of days after the purchase of the option, the buyer must pay the premium to the second party of the agreement in the form of a specified interest rate from the proposed transaction amount. The amount of bonus deductions is the minimum risk that a trader expects at a price that is unprofitable for him, since the right to repurchase the currency at the specified price can be used or not used.

Thus, unlike the exchange of the available currency for the interest, the acquisition of an option gives a chance to make a deal in the event of the expected profit at the time of the contract completion date or to refuse from it, having lost in the small (only bonus payment). You simply insure your own investments!

A currency option helps to hedge risks (hedging) with a sharp drop or a jump in the rate of interest of a pair of currencies. The current advantage is skillfully used by professional traders who profit profiteering on the difference in rates and receive not the minimum profits from successful purchase and sale, but much larger amounts, given the small value of the currency contract. A successful trader works with options, with little or no risk.

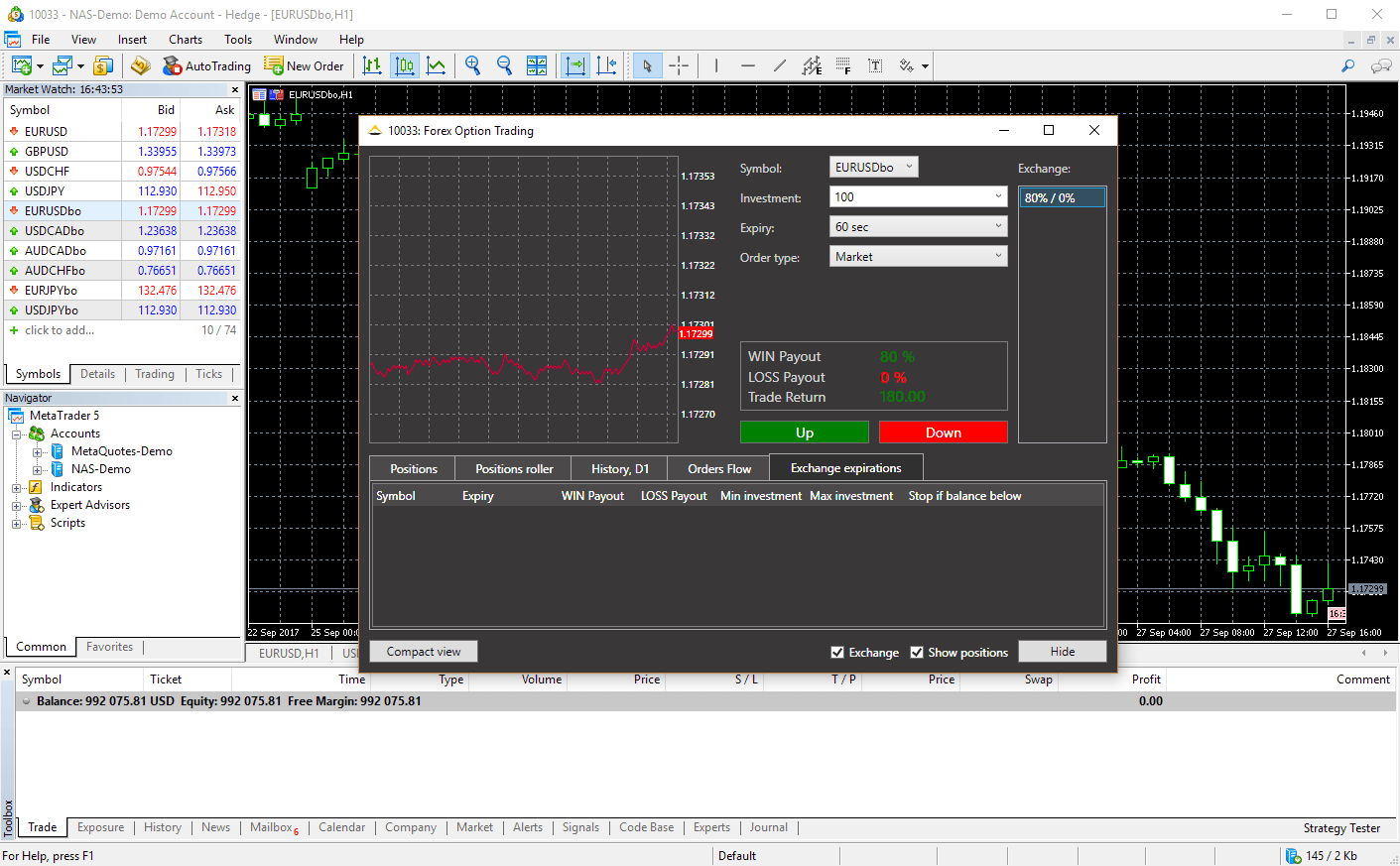

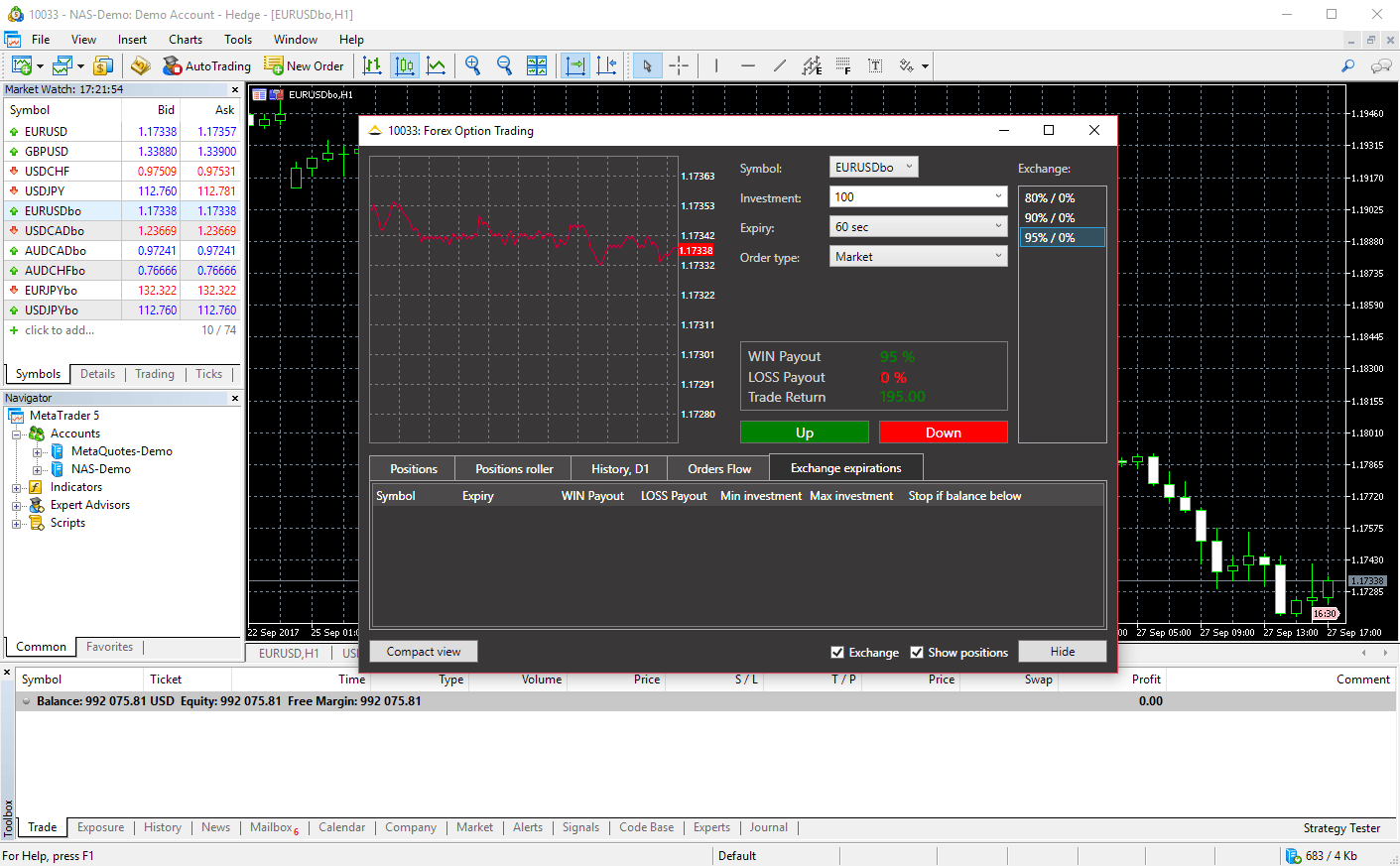

The introduction of options in METATRADER 4 and another trading platforms

On the leading platform for the exchange of currency pairs MetaTrader 4 and another trading platforms tools are introduced, the development and application of new options for trading currency options continue.

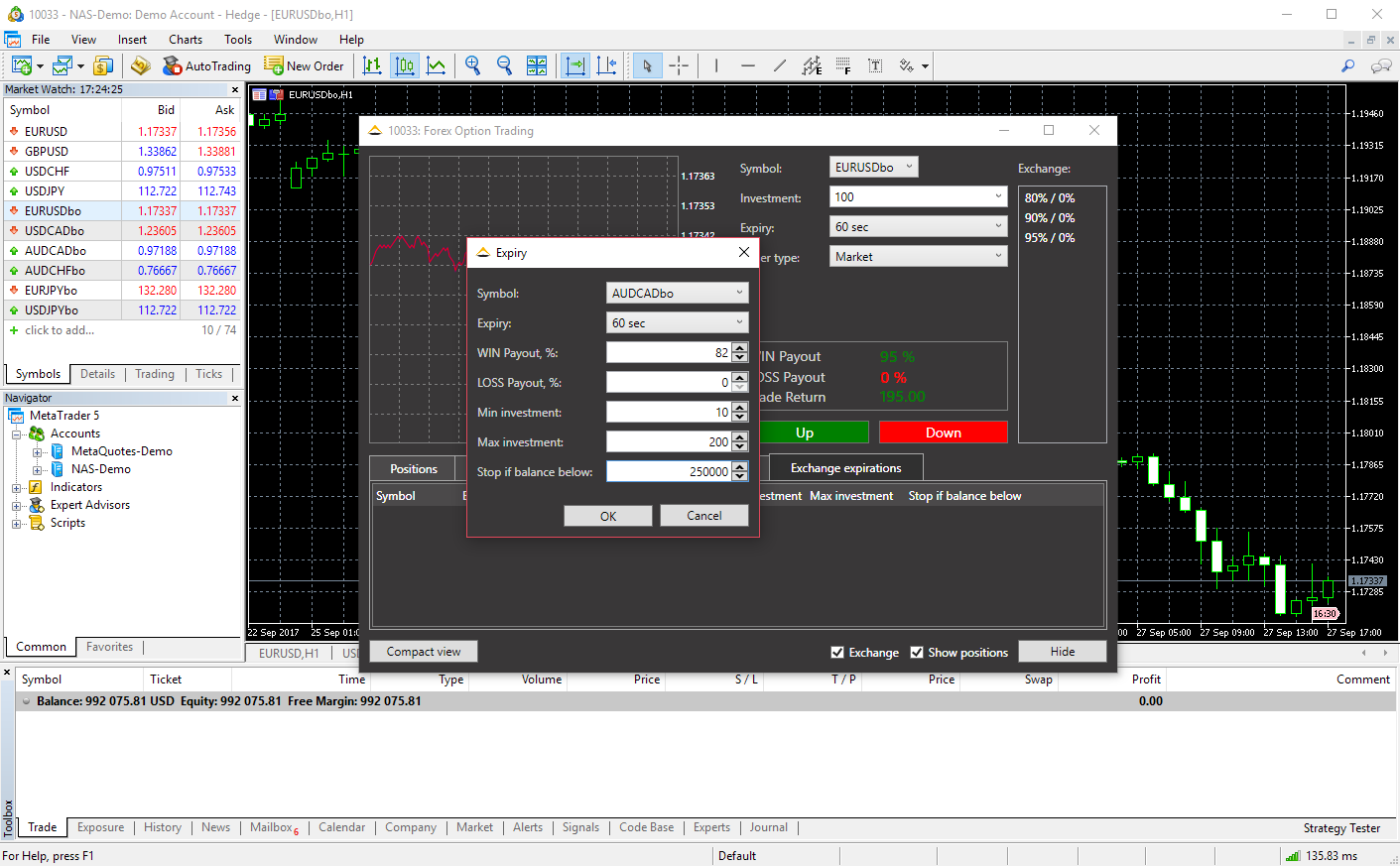

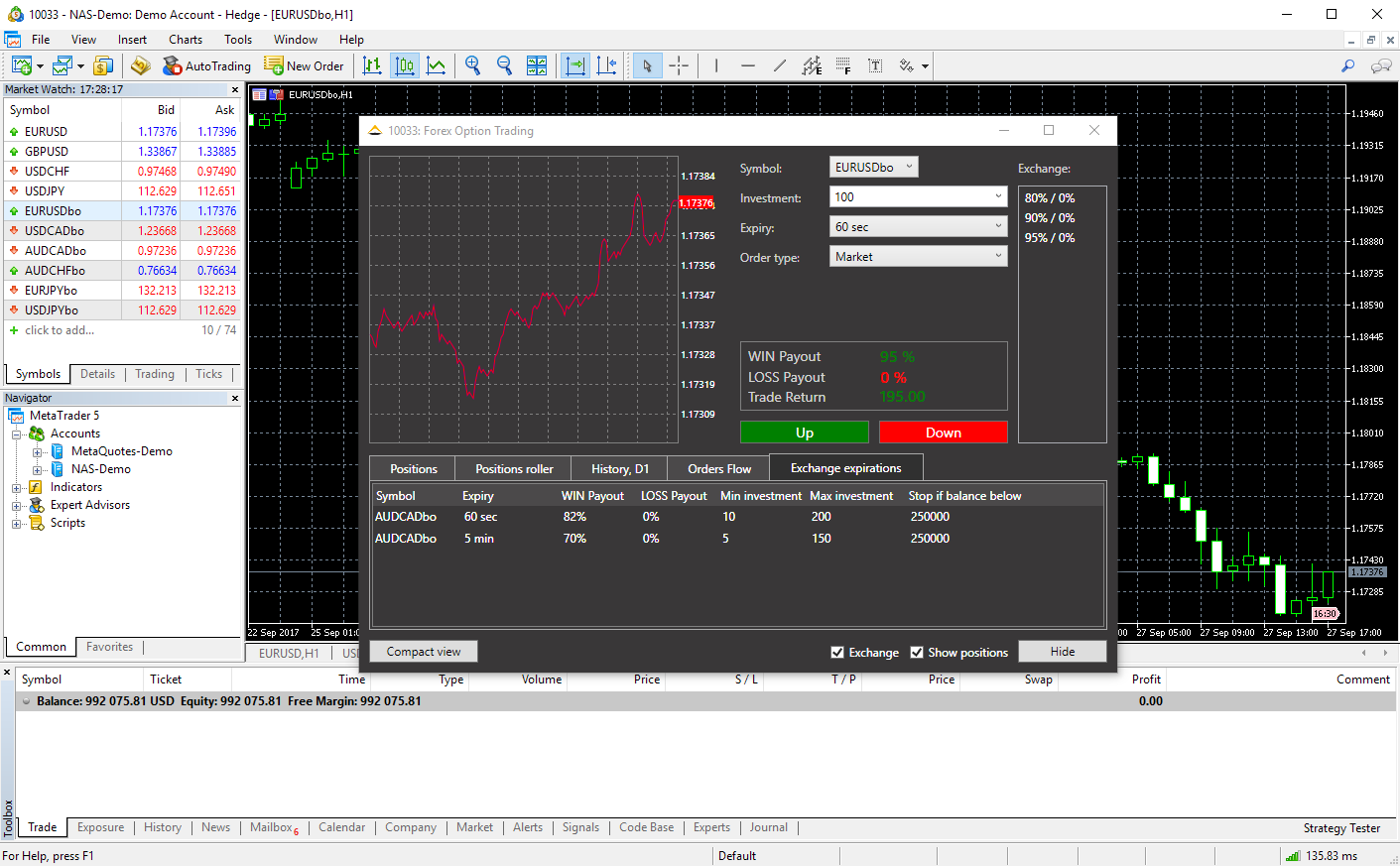

On the options board, you can find all available contracts for the next few days. When choosing the most successful for acquisition, one should understand the basic notation and use analytical tools.

There are two ways of insurance against failure - the use of call- and put-options. The put option allows you not to lose when the price falls with the acquisition of the right to sell the currency on the designated date in a month or quarter at a fixed price at the time of the transaction. By analogy, the call option will help to fix the value of the underlying asset when forecasting an increasing position.

With the acquisition of the described rights, a bidder at a stock exchange will be able to receive the highest profit corresponding to expectations.

So, in MetaTrader 4 and another trading platforms you can buy and sell call and put options, give an initial analysis of the effectiveness of the transaction already based on the data of the basic table of the options board with the sale price, the fair price derived from historical summaries, the coefficient and the schedule of volatility (expectations). Be sure to take into account the most important dates of the transaction, which marked the date and time of the beginning of the contract, the date of its completion, the timing of payment of the premium and the repayment or sale of currency, if desired, to use the acquired right.

For greater convenience and effectiveness of trading on the MetaTrader 4 and another trading platforms, a new tool is proposed - the builder of option strategies. So a trader gets a chance to collect different options in one investment portfolios, conduct an assessment of profits and risks.

Like all helper mechanisms, the builder is characterized by simple control. Combinations of options are subject to profit and loss analysis, the evaluation of the Greeks, the results of the performed work can be presented graphically. For each option, you can view more than 30 types of key strategic decisions. In addition to the built-in strategies, you can also use your own created control mechanisms.

Choose the way of professionals, become an investor, which, regardless of whether the market is growing or falling, is in a favorable position!